Explore our Year in Review and Outlook for 2025, highlighting key projects from 2024, insights into China’s evolving landscape, and a global perspective on advancements in robotics and industrial AI. I also share thoughts on the growing optimism in the US and its potential impact on Europe’s future trajectory.

What we have been working on during the past year

I spent roughly a quarter of the year in China again, and despite the current economic malaise, I enjoyed it. The dynamics in industries such as robotics, electric vehicles, and their respective supply chains are unmatched. My second home, Shanghai, benefits from visa-free entry for travelers from a multitude of countries, and I have the feeling that it might be coming back as a global metropolis.

Corporate Clients

A bit more in detail, our work focused on the following topics:

Several projects related to robots and industrial automation, with a particular focus on China.

We revisited machine tools and industrial sensors in China – both industries where large Chinese players showed little interest, while smaller ones lacked the technological skills and financial means to make noteworthy progress until recently.

Construction machinery – Also in this industry, China is setting new standards in electrification and pushing into global markets. I summarized some of the trends here.

We are hedging our bets with work outside of China:

We took a closer look at the European market for collaborative robots.

Another project analyzed the market for virtual factory software, with a particular focus on Europe and North America.

Our team in Germany launched a new workshop concept connecting mobile machinery OEMs with suppliers, enabling direct discussions on product requirements and applications.

We also took the first steps in analyzing the potential for automated disassembly of end-of-life vehicles in Europe.

Startups

In our work with startups, the following highlights emerged:

We connected the inventors of a new robot design with one of Europe’s leading research institutions to develop the product towards market maturity. The prototype has been installed and will undergo further testing. We hope to share more in about a year.

Supported a Swiss robotics startup in its efforts to establish partnerships in China.

In June, it was finally revealed that Apple had acquired Drishti last year – their technology is now helping Apple improve factory efficiency. This validates that we were onto something significant. Deltia is now stepping in to fill part of the gap, and we successfully introduced them to a new client in Switzerland.

Keynotes and Events

A few highlights from speaking engagements and events this year:

May – Visited the world’s leading battery manufacturer, CATL, and delivered a keynote on the electrification of mobile working machines at the VDMA Management Meeting in Ningde.

November – Returned to Tongji University in Shanghai for a guest lecture – a meaningful visit to the place where my journey with China began 18 years ago.

Local Engagements – Delivered talks in Lörrach and Nürtingen.

In June, we inaugurated our new office in Shanghai in collaboration with Ebner Stolz. This partnership allows us to cover the strategic, financial, and legal aspects of transactions.

Outlook 2025

There are many forecasts for the coming year. I’ll limit myself to a few observations - some immediate and related to our business, others more cultural.

Expectations for China

China is grappling with an economic crisis of a magnitude not seen in the past 20 years. From a German perspective, adopting a condescending tone toward this situation seems neither appropriate nor constructive.

1. Trump and tariffs

There are many possible scenarios for 2025, but Trump and tariffs top the list of concerns. Interestingly, most Chinese I speak with prefer Trump over Biden or Harris. They view him as more transactional and less focused on ideological competition, which many perceive as hypocritical.

The exact outcome is hard to predict. As I write this, it’s still unclear whether Chairman Xi will accept the invitation to Trump’s inauguration. While most experts doubt it will happen, such an unconventional move could be the right step to reset US-China relations after the disruption of the past five years.

Since I am often asked about Taiwan, I’ll share this observation: The strongest opinions about an imminent invasion often come from those who haven’t been to China in years. Meanwhile, the enthusiasm for escalation seems greater in Western think tanks than among the people I interact with on the ground (it is basically non-existent).

Overall, competition between the two superpowers will continue to shape global politics. Parallel globalization, technological bifurcation, and diverging standards will increase costs – disproportionately affecting small and medium-sized companies.

2. Short term implications

Over the past few years, the focus for foreign companies in China has shifted. Margin pressures and intensified competition – increasingly from domestic companies – are replacing the emphasis on top-line growth. Cost-cutting is now the priority.

This shift presents a dilemma. Keeping pace with fast-moving Chinese competitors demands significant investment. However, organizational distance and the recognition that they are not local companies limit the appetite of foreign firms to allocate resources at the required scale.

3. China isn’t going anywhere

I believe Western media and policymakers are overly fixated on China’s problems. While these challenges are real, this narrow focus has created a blind spot for large parts of the Western public regarding China’s rising technological and geopolitical clout.

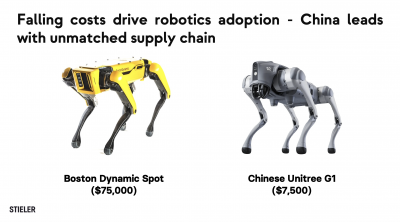

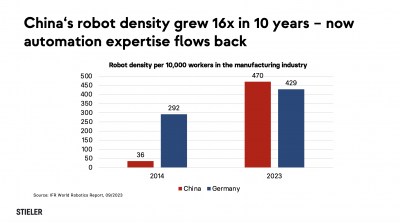

This is particularly evident in supply chains for electric vehicles, drones, and robotics. The Greater Bay Area is rapidly becoming a key hub for mechatronics. While some advocate for decoupling, many of our clients are actually expanding their sourcing operations there. No other region can match China’s ability to iterate products so quickly and cost-effectively at this point. It is not impossible to change this with radical de-regulation and a stronger focus on building things in the West, but this will take some time.

Meanwhile, Chinese companies are expanding globally. Inovance, a rising leader in industrial automation, currently generates less than 5% of its revenue outside China. The company has announced plans to grow that figure to 20% within five years. Similarly, Estun, China’s top industrial robot manufacturer, aims to capture 10% of the European market by the end of the decade.

4. China’s AI community could become a major player in global markets

Critics argue while China may lead in certain technologies, institutional and cultural limitations could prevent the country from realizing its full potential. Technological change is inherently destabilizing and this is difficult to handle. Despite significant investments, China could claim only a handful of major breakthroughs.

However, Chinese researchers continue to defy expectations. In late December, a Chinese AI model called DeepSeek v3 emerged as a competitor to the latest versions of ChatGPT and Claude – at a fraction of the cost (just $5.8 million, or less than 1/10 of the GPU training hours Meta needed for its Llama 3.1 model). Not only is DeepSeek open source, but it is also highly cost-effective, making it likely to become one of the most widely used AI models for programming. Scarcity makes inventive.

Beyond China

Beyond China, we see potential breakthroughs in robotics, industrial AI driving efficiency as well as a newfound optimism in the US, potentially influencing Europe.

Historically, trends from the US influence Europe. I am hopeful that some of this renewed focus on pride, vigor and achievement will eventually resonate here as well.

Technological breakthroughs in robotics

We remain optimistic about robotics innovations that will make robots more flexible and widely adopted. Whether this happens in 12 months or three years is uncertain, but models like Worldai, Sora, Meta Motivo and the whole NVIDIA Omniverse platform are driving progress at an accelerated pace.

AI is already driving efficiency in industrial companies

We are seeing that AI is having its first significant impact on improving industrial efficiency. We have some potential collaborations with industrial AI companies in the pipeline, including from the US.

An optimistic future of abundance

Venture capitalist Marc Andreessen recently commented, “It’s morning in America.” The mood in the US feels markedly different from that in Europe – driven by optimism and the belief in abundance, as opposed to the degrowth narratives dominating German politics and media.

According to Andreessen, San Francisco remains the cultural and technological epicenter of the world. It was the first city to fully embrace woke culture – and he predicts it will be the first to move past it. It’s fascinating to observe the shifting Overton window in real time.

How will Europe respond to the most business-friendly US administration in decades?

Many in Europe remain skeptical of the changes unfolding in the US and Argentina. However, if these business-oriented policies begin delivering results – as they already have in Argentina, faster than anticipated – European elites may have to reconsider their approach. Historically, trends from the US eventually influence Europe. I am hopeful that some of this renewed focus on pride, vigor and achievement will eventually resonate here as well.

Happy New Year 2025!